Part 1 – Harnessing the power of compounding in investment portfolios

How does compounding work? When your investment appreciates, and you do not withdraw any money then any further investment growth will be on the original investment plus the amount you have already accrued. While this may be well understood, how many of us fully understand its power?

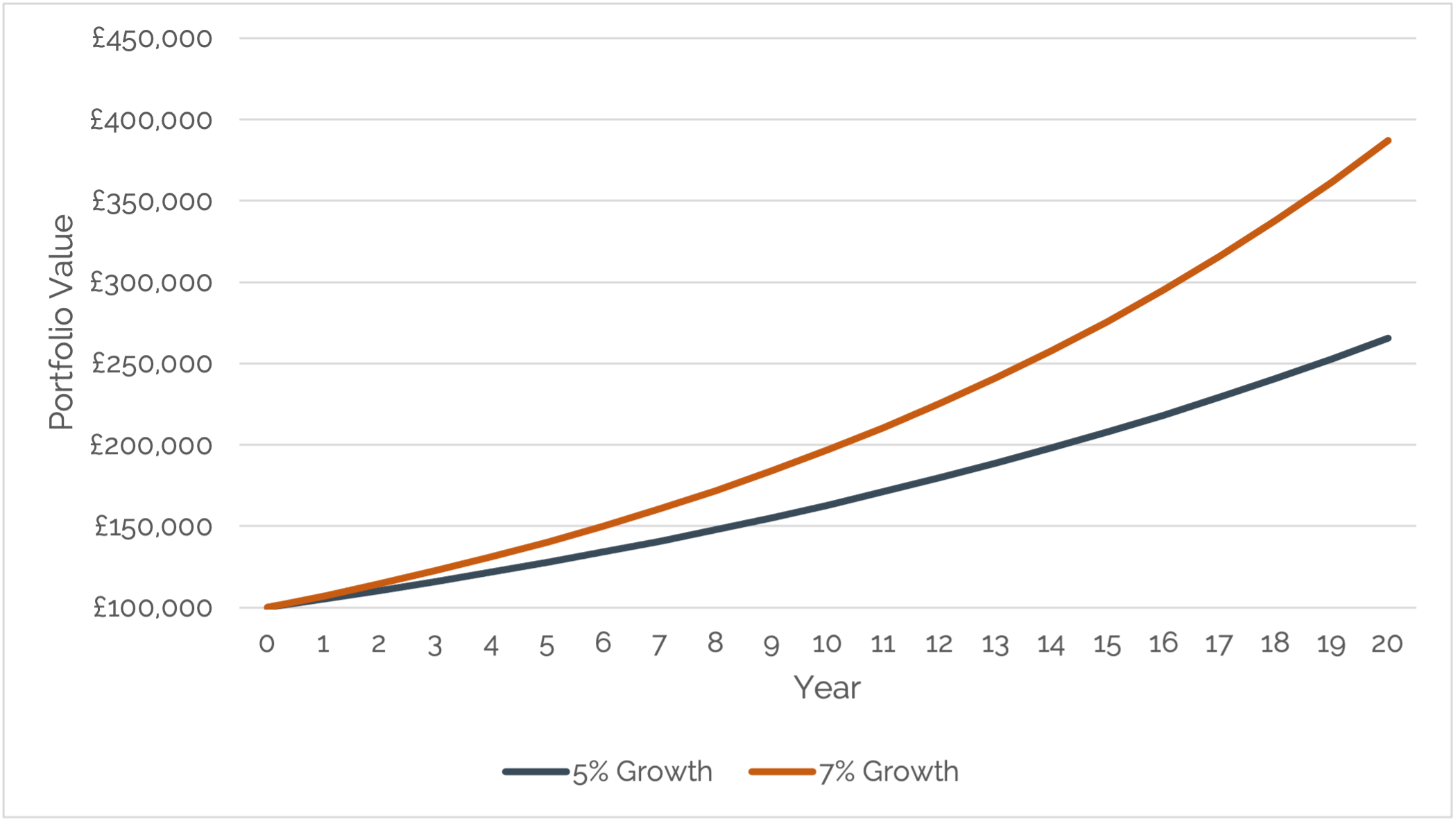

This is what happens when you invest £100,000 at the beginning of year 1. Assuming your investment appreciates by 5% gross per annum, at the end of 20 years, this could be worth £265,330. If your investment appreciates by 7% gross per annum (S&P 500 annualised return since its inception in 1928 is 9.9%) then your initial investment could be worth £386,968.

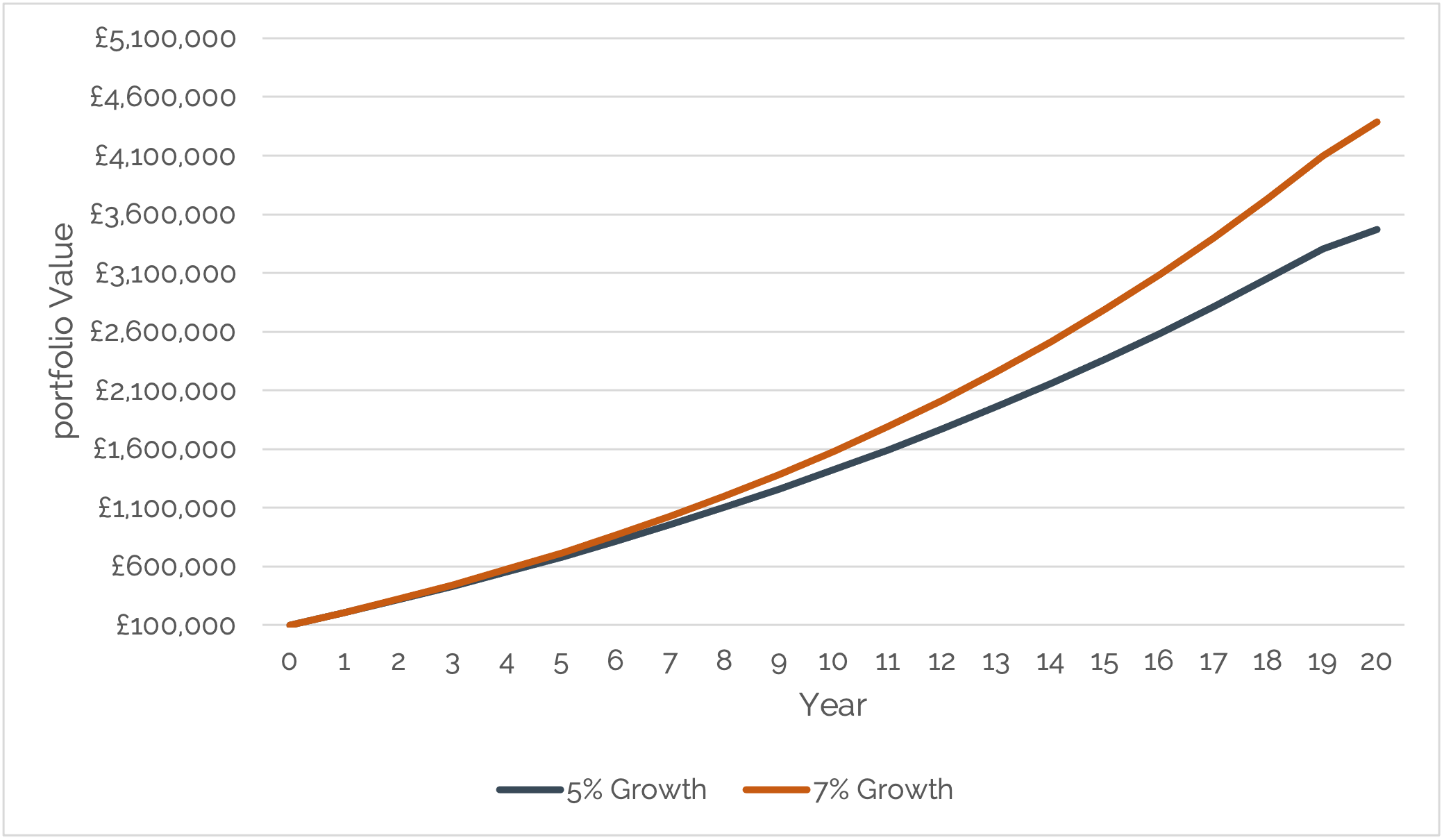

However, the compounding effects really begin to show when you invest £100,000 at the beginning of each year in the period including year 20. At the end of this period, you will have invested £2 million which if it appreciates by 5% gross per annum, your portfolio could be worth £3,471,925. If you assume an average 7% annual growth rate, then this could grow to £4,386,518 which equals 119% appreciation on your investment.

None of this is a new phenomenon. However, it highlights the importance of investing, staying invested and the effect of adding to your investments without trying to ‘time’ the market. If you make investments on a regular basis, it may be that at some times share prices will be lower than previously and at other times, they may be higher but on average this should give you a fair chance of reasonable long-term returns.

In Part Two of this series (published next Wednesday 6th March) we will explore the things you should consider to ensure this ‘compounding’ phenomenon is maximised.

If you would like to discuss this or any other aspect of investment please contact Philippa Armitage (Philippa.armitage@www.darblaywealth.com) who is a Senior Investment Director on the Investment Consulting Team or your Strabens Hall financial advisor. We would be delighted to hear from you.

Strabens Hall Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”). Our FCA registration details are set out in the FCA Register under firm reference number 461795 (www.fca.org.uk). Strabens Hall Ltd is registered in England and Wales (registered number 06015275) and our registered office is 5 – 9 Eden Street, Kingston upon Thames, Surrey, United Kingdom, KT1 1BQ.

Some of our services are not regulated by the FCA. Before you engage us in any work, we will outline which of those services are and are not regulated by the FCA to enable you to make a fully informed decision.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. All complaints for referral should be submitted to Strabens Hall Ltd prior to approaching the Financial Ombudsman Service (FOS). Full details can be found on its website at www.financial-ombudsman.org.uk.